Warning: Trying to access array offset on value of type bool in /home/smarteduverse.com/blog.smarteduverse.com/wp-content/plugins/sitespeaker-widget/sitespeaker.php on line 13

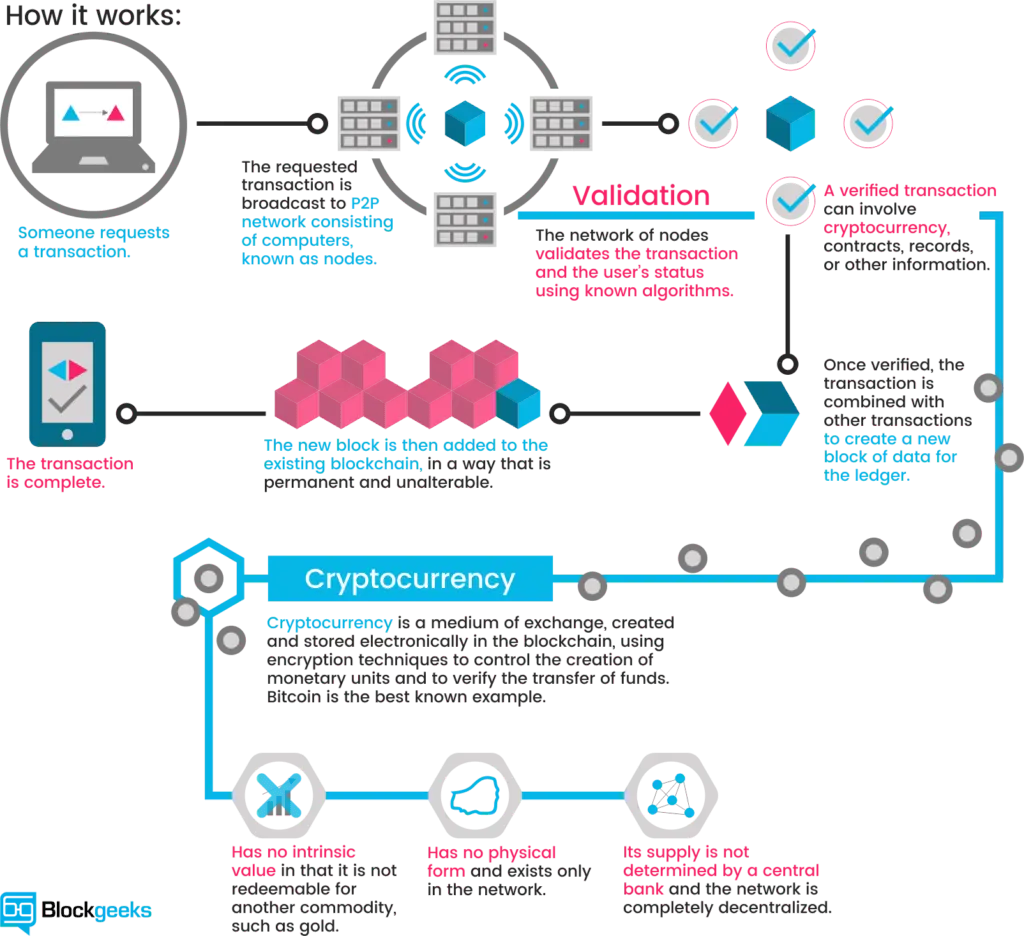

Cryptocurrency, also known as crypto, is a type of digital currency used as a medium of exchange. It employs cryptography to secure and verify transactions, as well as to regulate the creation of new units of a specific digital currency.

A distributed ledger enforced by a network of computers known as the blockchain underpins several cryptocurrencies. Due to the lack of a central issuing authority, which makes them theoretically immune to government interference or manipulation, cryptocurrencies are distinct from fiat currencies like the US dollar or the British pound.

How Do Cryptocurrencies Work?

Most cryptocurrencies run well without the support of a government or central bank. The functioning of cryptocurrencies is supported by decentralized technology called blockchain, as opposed to depending on assurances from the government.

Bitcoins are not a collection of bills or coins. They rely only on the internet to survive. Think of them as virtual tokens, the worth of which is determined by the forces of the market established by individuals looking to buy or sell them.

The practice of “mine,” which involves using computer processing power to solve challenging mathematical problems in order to earn coins, creates cryptocurrency. Additionally, users have the option of buying currencies from brokers, which they may then store and use through encrypted wallets.

Consensus algorithms that use proof-of-work (PoW) or proof-of-stake (PoS) commonly power blockchains. PoW relies on miners, who frequently dedicate particular computing devices for the activity.

Who Historically Had An Influence On Cryptocurrencies?

Over the years, a number of individuals have had a big effect on the bitcoin sector. The industry was launched by Satoshi Nakamoto with the development of Bitcoin (BTC). Vitalik Buterin, who is best known for creating Ethereum (ETH), has had a significant influence on the cryptocurrency movement. With Ethereum comes a new class of additional tokens called ERC-20 tokens that were produced on its network.

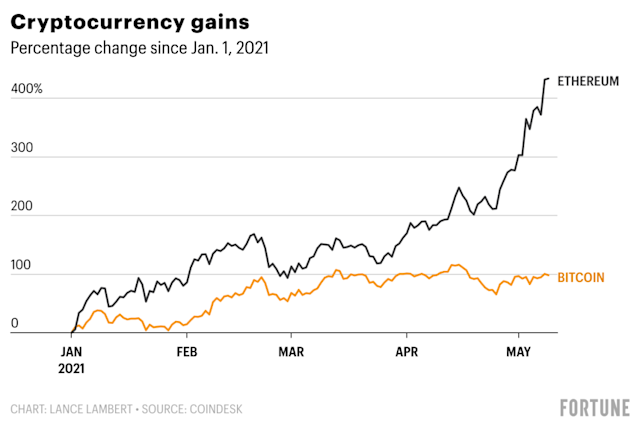

Why Are Cryptocurrencies So Volatile?

Due to the industry’s youth, there is a lot of volatility in the cryptocurrency field. Investors want to play with their capital in order to make quick money and learn how cryptocurrency values fluctuate and whether they are affected by them.

Cryptocurrency prices are influenced by how many people use them (i.e., their usefulness) and for what purposes. If more individuals utilize them to make purchases instead of merely keeping them, the price will increase.

Scarcity is another factor that influences bitcoin value. This makes reference to the limited mechanism of cryptocurrencies. The total number of Bitcoins that may be mined is limited to 21 million per the Bitcoin protocol. Therefore, as more individuals enter the cryptocurrency industry, Bitcoin’s scarcity will unavoidably rise, driving up its price. Some coins also employ the technique of burning to raise their value by obliterating some of the supply.

A cryptocurrency’s price may fall if large quantities of accounts that possess it start to sell. If a group of persons decides to sell crypto assets, these accounts are known as “whales” since they have a sizable holding and can affect the market.

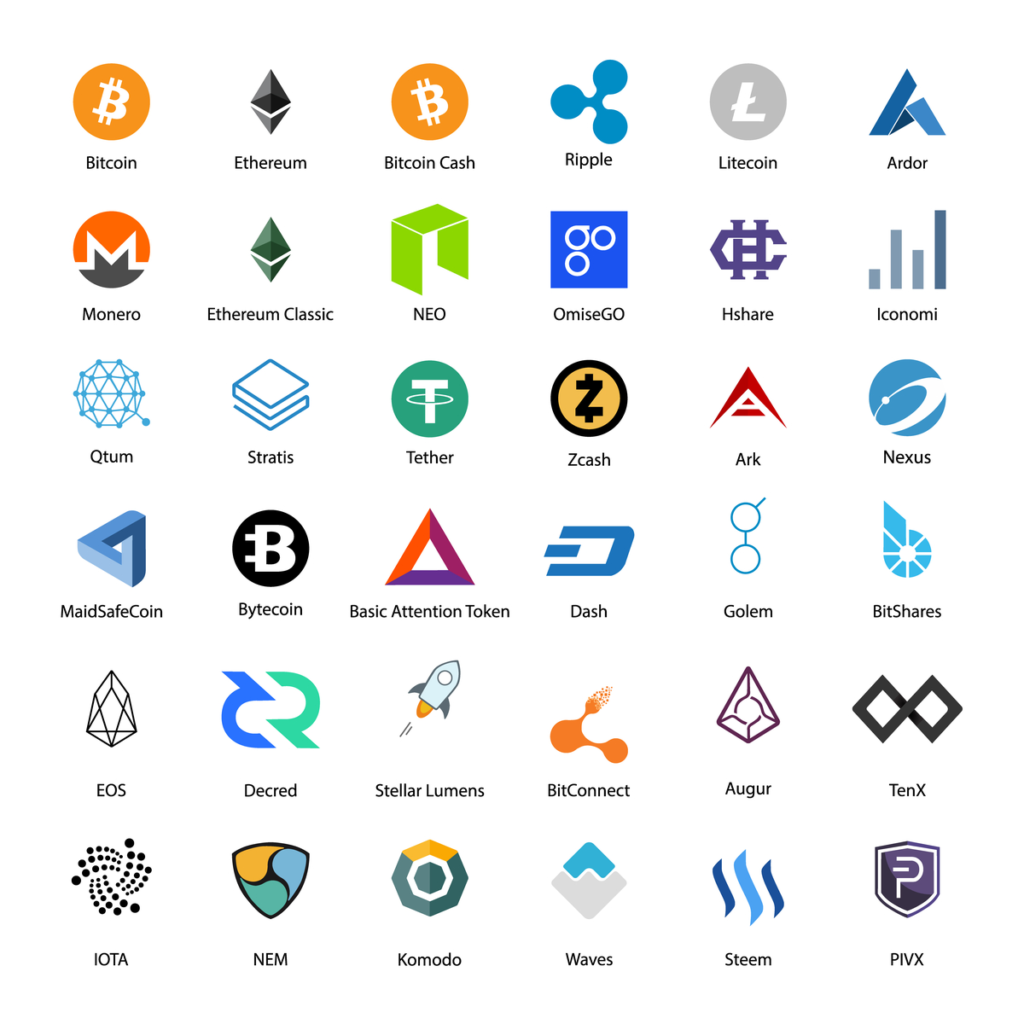

Types of Cryptocurrencies

The following two classes of cryptocurrencies can be used to categorize various types:

Priorities first Understand the distinction between a token and a coin. You might regularly hear the words “coin” and “token” spoken while talking about cryptocurrencies. Despite the fact that they may sound similar, there is a distinction. It’s critical to maintain their accuracy.

A digital coin functions very similarly to traditional currency and are produced on its own blockchain. It may be used as a means of trade between two people conducting business together as well as a way to store value. Bitcoin and Litecoin are a few examples of coins (CRYPTO: LTC).

On the other hand, tokens are much more versatile than merely digital currency. On top of an existing blockchain, tokens are produced and may be incorporated into software applications (like granting access to an app, verifying identity, or tracking products moving through a supply chain). They could depict digital art (like with NFTs, or “non-fungible tokens” that certify something as unique). Even the use of NFTs with tangible assets, such as actual works of art and real estate, has been tested. On the Ethereum (CRYPTO: ETH) network, one type of token that is utilized to carry out transactions is called ether.

Are Digital Currencies Legal?

The globalization of the cryptocurrency business has prompted the need for regulation. The American government has increased its monitoring of space throughout time. Following the frenzy of 2017 and 2018, the Securities and Exchange Commission (SEC) tightened regulations on initial coin offerings or ICOs. Other American organizations, like the Commodity Futures Trading Commission (CFTC), have also participated in various roles.

Additionally, due to changing regulatory standards, crypto regulation outside of the United States has evolved over time. For instance, the fifth Anti-Money Laundering Directive from the European Union mandates that cryptocurrency purchasing, selling, and other operations in particular countries must adhere to specific rules.

Since the cryptocurrency sector is very young compared to other sectors, there isn’t currently complete legal clarity about the criteria for all facets of the industry. Asset categorization is one aspect of such clarity. Although many other assets are still not clearly classified, Bitcoin and Ether are seen as commodities.